santa clara county property tax credit card fee

Includes the 1000 Real Estate Fraud Prevention Fee. To avoid financial penalties the second installment of the 20022003 property taxes must be paid by 500 pm Thursday April 10 2003.

Fine Missouri Fuel Tax Refund Form 4925 In 2022 Tax Refund Tax Refund

Electronic Check eCheck No Fee.

. You will be levied a fee for credit card or debit card. Include your mailing address the Parcel Number suffix and installment number of the bill being. 5000 Contractors or Sub-contractors filing a Preliminary 20 Day Notice.

For Secured property only DEPARTMENT OF TAX AND COLLECTIONS PO BOX 60534 CITY OF INDUSTRY CA 91716-0534. The approved changes took effect on July 1 2017 and impact REALTORS brokers and rental property owners of single family homes and duplexes. It costs 2 for each class.

Besides your payment we charge processing fees for credit cards. Santa Clara County California. A non-refundable processing fee of 110 is required in Santa Clara County.

The County of Santa Clara uses FIS Global to process credit card and e-check payments. Department of Tax and Collections. Use the courtesy envelope provided and return the appropriate stub scoupon s with your payment to ensure timely processing.

Nevertheless some information may be out of date or may not be accurate. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. UCC filing fee for one to two pages.

The County of Santa Clara assumes no responsibility arising from use of this information. Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. The adjustments to the business tax that took effect on July 1 2017.

Please note that additional credit card processing fees will be charged in addition to your payment. Since the County is by law not allowed to collect less than the actual tax amount any fees for processing this credit card payment must be paid by you. 238 of that would be 952 million.

Credit Card American Express Discover MasterCard Visa 225 with 200 minimum. The county does provide a web portal to pay your tax bills. This service has been provided to allow easy access and a visual display of County Assessment information.

This includes a 1000 Real Estate Fraud Prevention Fee except for documents subject to documentary transfer tax pursuant to SB 1342 Chapter 104 amending Govt. Property taxes are levied on land improvements and business personal property. A reasonable effort has been made to ensure the accuracy of the data provided.

If You Use A Credit Card In Santa Clara County Can You Pay Property Tax. San Jose CA 95110-1767. Visit their website and pay your real estate tax bill online.

Visa MasterCard American Express and Discover are some of the credit cards accepted. The Santa Clara County Tax Collector collects approximately 4 BILLION per year in property tax. Debit NYCE Pulse STAR.

250 with 200 minimum. Here is the Santa Clara County Property Tax Mailing Address. A secure online payment system will make it convenient for property owners to pay their taxes said Cheryl Johnson Santa Clara County Tax.

Either the people who want to use credit cards can pay that 95 million - or everyone in the county can pay it. Checks should be made out to County of Santa Clara. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

Important changes have been made to the San José business tax which was approved by San José voters on November 8 2016. Property Tax Fee Amount Business Tax Fee Amount. City and County of San Francisco.

If you use a credit card to pay there is a minimum fee of 20. Credit card payments for the processing fee are accepted in person at our office. East Wing 6th Floor.

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

What Is A Homestead Exemption California Property Taxes

Do You Know What Dmv Fees Are Tax Deductible Fair Oaks Ca Patch

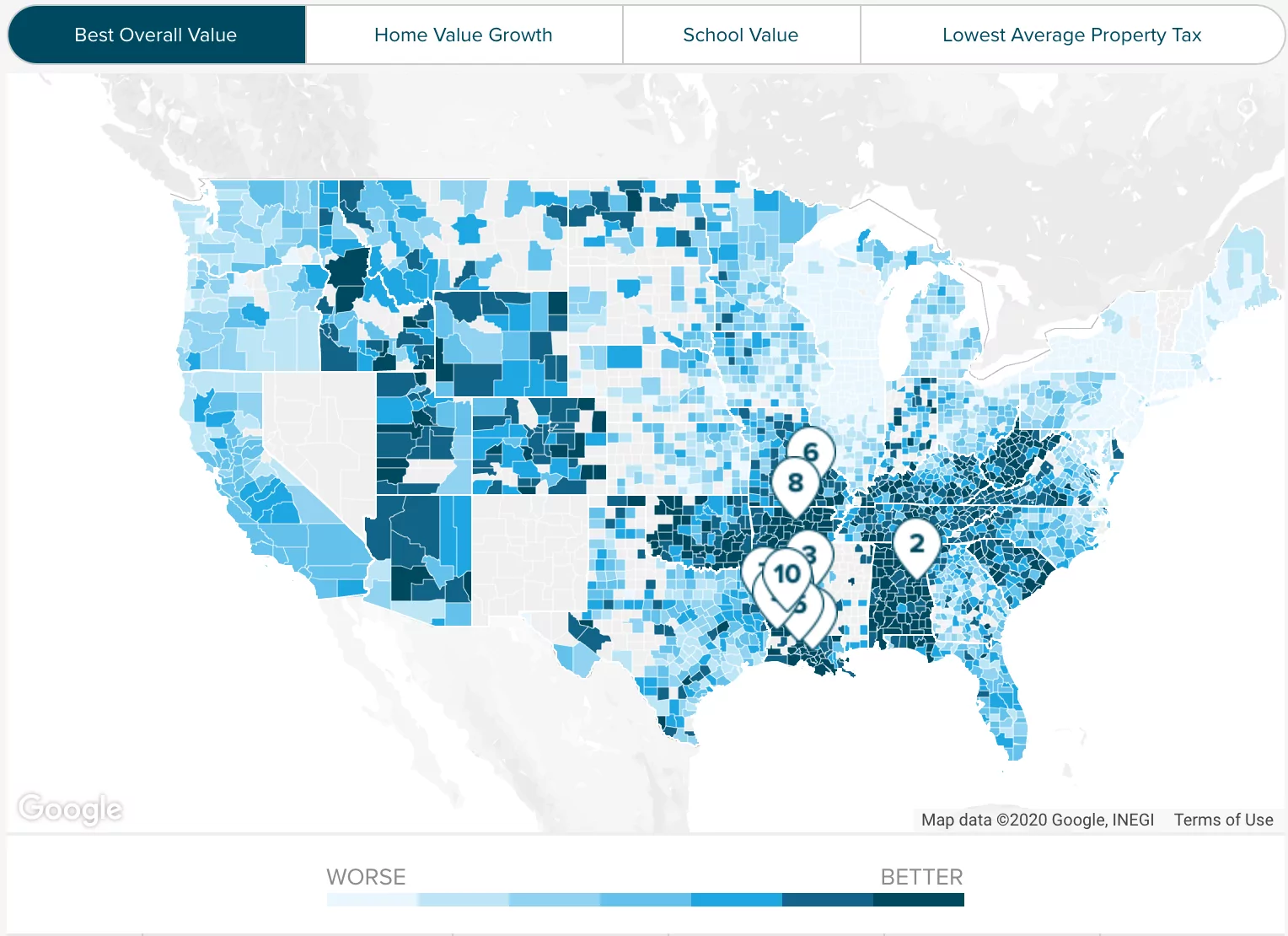

Santa Clara County Ca Property Tax Calculator Smartasset

Top Five Tax Surprises With Multiple Jobs Overemployed

Santa Clara County Ca Property Tax Calculator Smartasset

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

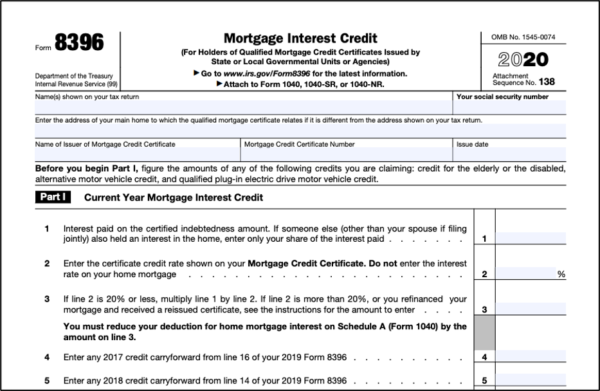

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

211 Bay Area 211bayarea Twitter

County Of Santa Clara Old License And Certificate Of Marriage Signed By Brenda Davis Marriage Signs Lease Agreement Free Printable Santa Clara County

R D Tax Credits Provide New Opportunities For Artificial Intelligence Start Ups R D Tax Savers

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

3 11 13 Employment Tax Returns Internal Revenue Service

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Hardship Letter Template 05 Lettering Reading Lesson Plan Template Business Letter Template

Property Taxes Department Of Tax And Collections County Of Santa Clara

Stimulus Checks The States Releasing New Payments For May 2022 Marca