tax on forex trading in india

As per the latest available the current rate of tax. This stated that the tax imposed on forex transactions is between 5 to 18 similarly to business.

What Is Forex Trading Forbes Advisor

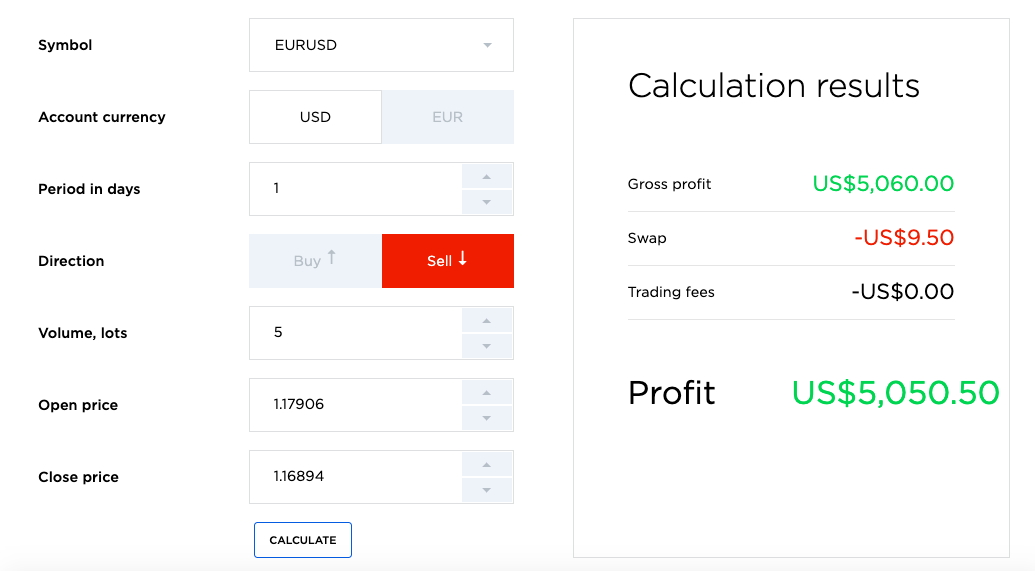

Value of currency exchanged 66 12000 792000 Upto 100000 1000 For 692000Rs 3460 050692000 Value of supply 4460 Conclusion Neither The Income Tax nor the GST Rules are harsh on forex.

. Tax Classification in India. A has exchanged US 12000 to INR 66 per US The value of supply based on the second method will be determined as follows. 3334 and accordingly they can claim it as their genuine income source.

Simply put the Indian government has restricted trading to only foreign currencies. Five percent of the amount over one lakh. 46 Overseas forex trading through.

Tax on Forex Trading in India. There is an applicable fee of up to Rs 180 for foreign exchange transactions involving less than one lakh rupees. When the Good and Service Tax GST was implemented on July 1 2017 the tax on Forex trading in India changed.

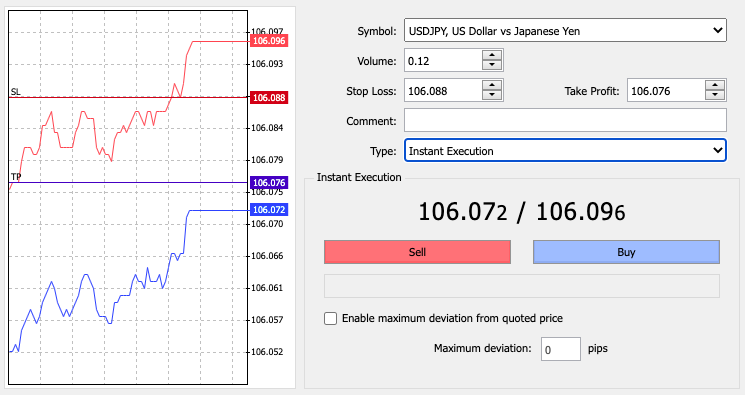

October 1 2020 foreign exchange transactions of up to Rs. Therefore the GST to be paid on a forex transaction worth Rs. Add Orders to Your Trade.

Choose a Way to Trade Forex. Sending money to foreign brokers. The country first implemented this tax on july 1 2017 and they made sure to have.

Transaction values are taxed at Rs 1000 plus or minus Rs 10 as in this category from Rs 100000 to Rs 1000000000. In other case it may be covered under the head Income from other sources. For a trade to be considered for long-term capital gains you need to have held the investment for.

If done through a registered broker traders can access and trade almost all currency pairs. 9 rows Taxation on Forex Trading in India. Taxes On Forex Trading In India.

If we happen to trade through SEBI approved brokers and getting any profit third point that is income from capital gains tax lab will be applied. The Reserve Bank issued a circular in 2013 related to is Forex Trading Legal in India Using electronic or online trading venues. Different Ways to Trade Forex.

The tax amount is 18 of the taxable value so the final GST amount falls between Rs 990 and Rs 60000. The STT tax is 0025 only on the selling value. 540 18 of taxable value 3000 Lower limit 1 lakh of GST to be paid in Slab 2 18 of 1000 Rs 180.

700000 is liable to TCS Tax collected at Source in the hands of the individual at 5 and 05 in. In July 2017 Prime Minister Narenda Modi launched GST. Pay corporation tax if trading as a limited company which is at least 18 Pay regular income tax up to 40 if you openclose trades more than once a month Pay Capital Gains Tax if you openclose trades only several times per year Most profitable traders will fall under 2 which is why its a lot more favourable to trade as as a limited company.

ITR Form ITR-3 For individuals and HUFs having Income from Profits and Gains of Business or Profession Due Date to file Income Tax Return for FY 18-19 AY 19-20 31st July 2019 If Tax Audit is not applicable. Vishrut Rajesh Shah CA Ahmedabad 783 Answers 30 Consultations 50 on 50 Talk to Vishrut Rajesh Shah Hi Vishrut Thanks for your reply. Forex trading is considered as business transaction and income is taxable as business profit.

We may need to file taxes under this clause. USD-INR EUR-INR GBP-INR JPY-INR As per RBI circular RBI2013-14265 AP. The stamp duty on your overall daily turnover is 002.

Brief Guide to Trading Forex. Income from FO Trading is classified as Non-Speculative Business Income for preparation of Income Tax Return. Aspiring forex traders might want to consider tax implications before getting started.

Stamp duties as per the state laws are applicable on forex transactions along with myriad transaction charges such as brokerage fees. Apart from these GST implications forex traders must also pay charges. Everywhere the regulations are different on this subject.

It generally involves banks corporations central banks hedge funds retail forex brokers and high returns to traders. I will try in this blog to explain as much as possible about what I know about paying the taxes on your forex earnings in different countries. You will also have to pay regulatory charges on daily turnover which amounts to around 0004.

Forex trading is legal in India and that is only possible if the investors follow the forex trading rules in India. Tax on forex trading in india. On the other hand Forex trading is considered lawful through designated India platforms.

Here is the maximum capital gains tax rate for individuals in some countries. You can only trade foreign currency paired with INR 4 pairs are allowed. Since then the government of india has mandated the payment of a fixed tax when traders partake in one or.

Intraday trading tax in Indias brokerages may seem high but this all adds up to a tiny proportion of your total profits. DIR Series Circular No. The Central Board of Direct Taxes CBDT in India breaks down the taxes payable into four categories.

If the person indulge himself in the business of forex trading such income shall be taxable under the head Business Income. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses. Taxable value 1000 Slab 1 05 of the amount above 1 lakh Slab 2 1000 2000 05 of 4 lakh 3000.

If your income is upto 5 lakh inclusive of all sources there wont be any tax If you are doing forex trading dont forget to take cognisance of other charges like stamp duty STT etc while working out profit from transaction. The base currency is INR Indian Rupees. By doing this we will get an advantage that is in case lets say we make loss we can apply Set off option.

5 Lakh is Rs. Replied 20 October 2009. Tax rate applicable applicable to individual is charged on such income.

First off yesforex trading in India is legalwith some restrictions of course. 700000 in a financial year are free from tax liability. The government of India has imposed so many restrictions on the currency pairs so that the forex reserves are kept safe and the question of forex trading in India is legal or illegal does not arise.

Trading in MCX-SX BSE NSE currency segment via registered brokers. Select a Currency Pair. The amount they are earning is offered fro tax at full rate ie.

Decide Whether You Would Like to Buy or Sell.

What Is The Punishment For Doing Forex Trading In India Quora

In Which Country Forex Trading Is Legal Forex Education

Forex Trading In Nepal Forex Strategies Benzinga

How To Start Forex Trading In India 2021 Best Strategies

Forex Trading 2022 How To Trade Forex Beginners Guide

Anmol Singh Author And Forex Trader Discusses The Path To Successful Trading Forbes India

What Is The Punishment For Doing Forex Trading In India Quora

What You Need To Know If You Want To Trade Forex In India

Forex Trading 2022 How To Trade Forex Beginners Guide

Tax Implication On Forex Transactions Goyal Mangal Company

:max_bytes(150000):strip_icc()/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

Indian Forex Trading Is It Legal Or Illegal For An Nri Sbnri

Is Forex Trading Legal In India Ipleaders

A Basic Guide To Forex Trading Forbes Advisor India

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

What Is Forex Trading And How To Trade Forex In India

Step By Step Guide To Start Forex Trading In India For Beginners 2022 Cash Overflow

Bitcoin Hitting A Few Bids Now On The India Potential Ban Story Under Us 59 5k Bitcoin Value Investing Money Bitcoin

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)